The implications of COVID-19 will be far-reaching and we won’t know for some time just how deeply all industries have been impacted by the global health crisis. While many consumers don’t know much about the oil and gas industry beyond what they pay at the pump, those who are watching a may be shocked to find that the current oil rig counts are very low and continue to drop even lower. The effects of COVID-19 are already readily apparent in the oil and gas industry and the impact is illustrated in current rig count trends.

Why Are We Concerned with Rig Count?

Rig count is often a topic of discussion when there are concerns or excitement about the economy or the health of the oil and gas industry overall. During times of economic uncertainty in the United States and around the world, many people who aren’t otherwise tapped into the oil industry will begin paying attention, as it is often used as a barometer of economic health. The rig count has become even more popular to watch in recent years as investors and traders attempt to discern when they should buy, sell, and trade their energy interests. While there is a lot of data to tell the experts what is going on with the industry, the number of rigs is often seen as a tangible explanation of the health of the US oil industry.

What is an Oil Rig?

When you imagine an oil rig you may be thinking of a big platform out in the middle of the ocean or the Gulf of Mexico. When we refer to rig counts we are not talking about those large platforms you may be envisioning. Rather, rigs are used to drill wells, which is where the oil will eventually be extracted from. When the initial drilling is complete, rigs are then moved off-site and the well is topped by a wellhead. While rig counts don’t always provide the whole picture of the health of the industry, it is helpful because the count illustrates what oil is being produced right now and looks at future sources through exploration and development.

What is the Current Trend in Rig Counts?

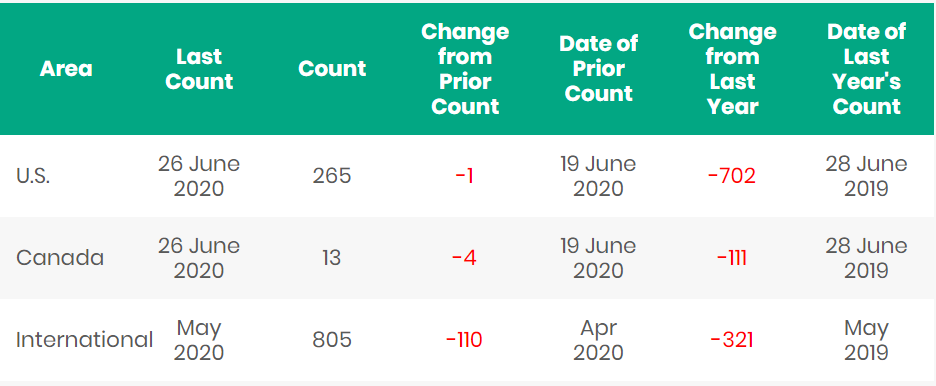

2020 has been a tough year for the oil industry. Rig counts have continued to fall from week to week for several months in a row. These falling counts are not just seen in the United States, but globally.

As of June 10, the rig count is down 64% from its mid-March level of 835. At this time E&P companies began releasing rigs and pausing activity because of the Coronavirus pandemic. Because of the pandemic, much of the world was on a stay at home order. Due to the stay at home order, consumers, and industries such as the airline industry, simply were not using fuel the way they had been. This created a situation where supply was outpacing demand. For a time, the world had more oil than it had space to store it.

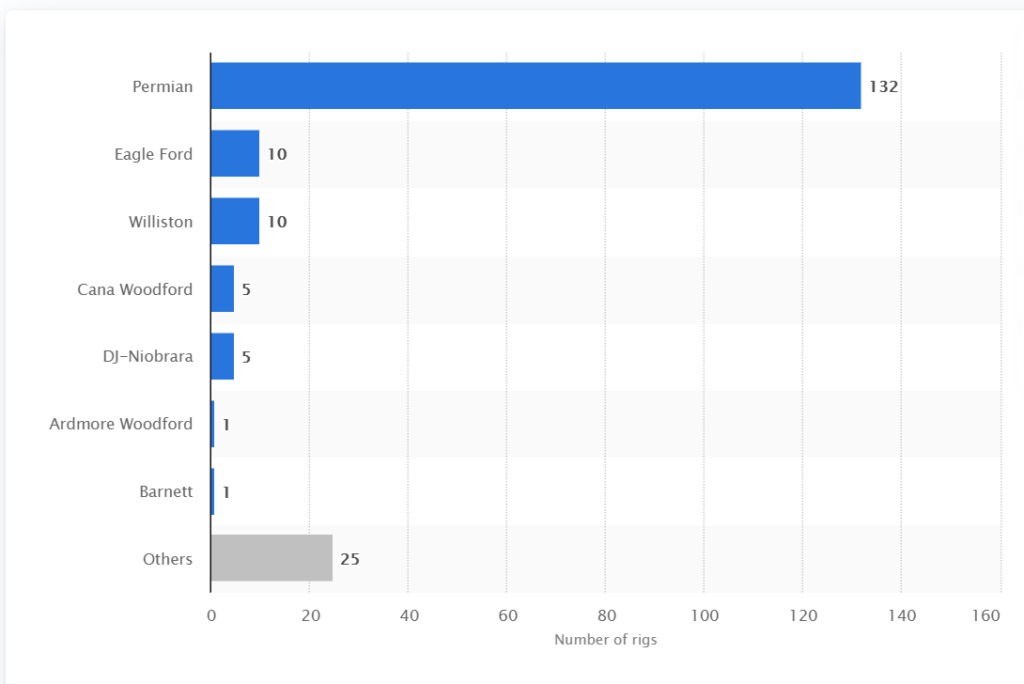

Current Oil Rigs in the United States by Region

When supply and demand are not strong enough to support the oil companies, the result is like any other industry, any new activity has to stop until the business can support work. Many workers in the oil and gas industries have been furloughed for the foreseeable future as the economy struggles amid COVID-19. In April, the industry reported a record-setting job loss of more than 26,300 jobs in Texas alone because the demand for oil just is not there.

What Happens Next?

No one is positive what the future holds for rig counts and the oil industry but it appears it will be some time before rigs come back online in any meaningful way. COVID-19 began impacting the industry in March of 2020 and as of June, the impacts are readily apparent. There have been signs along the way, as social distancing measures eased, that oil prices would begin to rise again and the industry would slowly bounce back. But now, with Texas and other states having to roll back reopening due to the increased spread of COVID-19, the future is more uncertain than ever before.

Matt Andre, an analyst for S&P Global Platts Analytics said he believes that rig counts appear to be close to a bottom. He said, “Rising oil prices helps to bring the curtailed wells back online, but it doesn’t promote new drilling.” He went on to say, “We expect rigs to slowly return once we can sustain above $45/b WTI but most of the other regions will have to wait for $45/b-plus maybe even $50/ to bring rigs back into action in a significant way.” A recent Platts Analytics Spotlight report stated that “Rigs will stay relatively flat until early 2021 as operators wait for several months of higher oil prices before starting to gradually increase the rig count.”

MSI Wants to Partner with You Even in Uncertain Times

MSI Pipe Protection Technologies continues aims to continue providing you with the best assortment of quality pipe protection in the industry in addition to timely updates and industry updates, even in uncertain times. Please contact us today for all of your pipe protection needs, download a copy of our catalog or request free samples to see exactly what we can do for you!