Global players in the oil and gas industry understand one major thing: governments’ political statements and public posturing can directly impact their bottom line. From shipping lanes to supply and demand, every aspect of the market relies on the relationships and trade agreements countries and allies fostered after the 2nd World War. As new players emerge, new partnerships disrupt the traditional status quo and elevate specific alliances to greater significance.

The industry operated this way for most of the 20th and 21st centuries. However, recent changes in both the technologies deployed and political unrest around the globe have led to previously uncharted waters specifically, we are referring to the ‘U.S. Shale Revolution.’ This shale boom meant that certain countries our economy depended on were no longer that important to political leaders. Similarly, markets that flourished in the early 2000s couldn’t compete once crude oil prices started trending downwards.

Historical Importance of Oil and Gas Industry Regions No Longer Apply

One country that the U.S. traditionally relied on for its oil and gas security was Saudi Arabia. As most of the oil wells and refineries were located on the west coast of Saudi Arabia, the security in the Strait of Hormuz remained of strategic importance to the U.S. The shipping lanes that delivered these essential resources required a global supply chain and strategic partnerships with regional allies, especially in the Middle East and Egypt (as the owners of the Suez Canal).

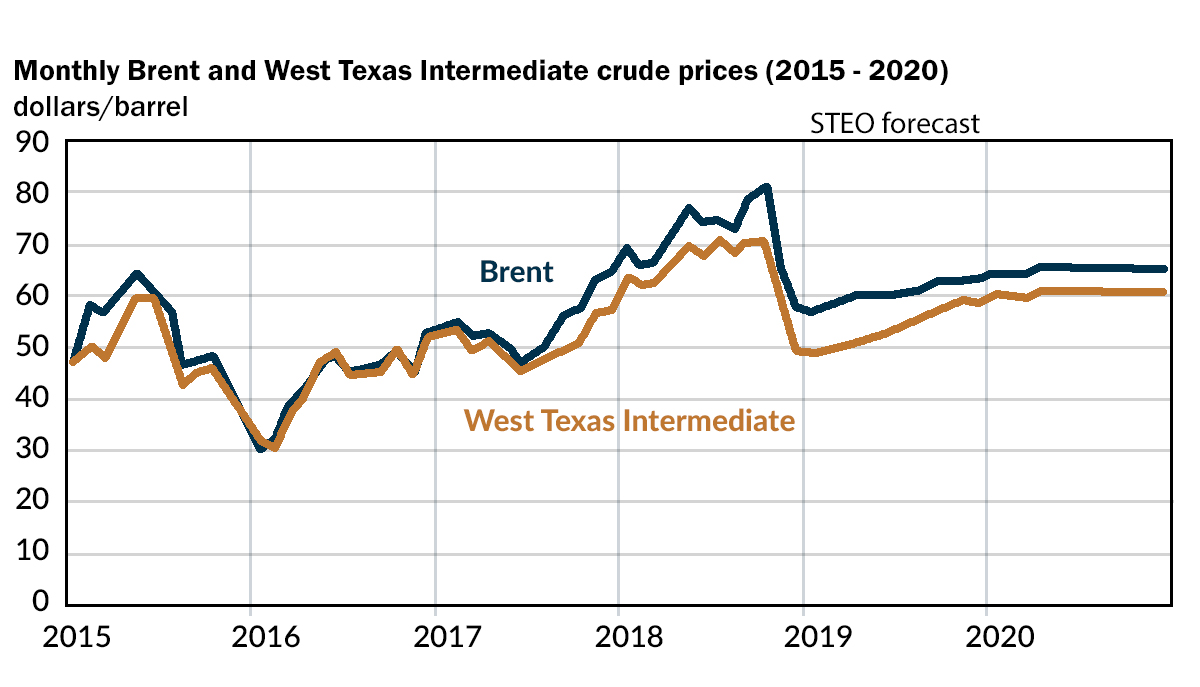

Tensions between the nations of Iran and Saudi Arabia continued to be a flashpoint in U.S. domestic politics. An attack in 2019 on Saudi Aramco’s production facilities (attributed to Iran by both the U.S. and Saudi Arabia’s governments) led to only a 5% reduction in global supplies. Compared to a historical high of 42.5% in the early 1990s, it clearly indicated a downgrade in the importance of the traditional powerhouse that is the leader of the OPEC nations.

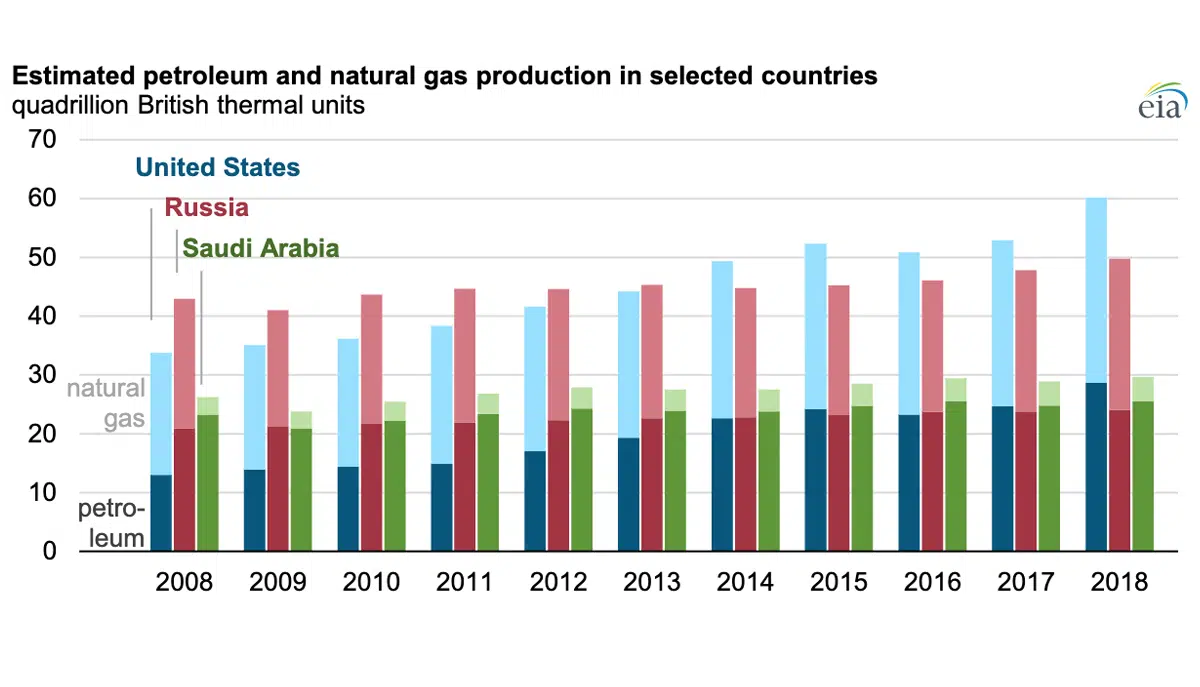

US Production Records since 2008

For the first time in decades, the U.S. now considers itself a net oil and gas exporter. As of 2021, the U.S. is the top petroleum liquids producer in the world and accounts for 20% of the world’s production.

This rise is primarily due to the political policies and concessions given to shale oil producers over the last decade or so. Stimulated by commodity investors, the industry quickly grew from 2008 to new highs in 2019 — domestic and offshore production techniques allowed U.S. producers to recommission wells they previously didn’t consider as viable. While shale oil and gas production methods remained in the public spotlight, politicians and officials understood that they needed to take bold steps toward energy independence.

Although the attack on Saudi Aramco led to a spike in crude oil prices on the global market, strategic reserves in the U.S. economy should limit the impact on consumers. The U.S. consumes less than it produces but still exports and imports oil and gas from strategic partnerships with countries in the Middle East and Africa. By no means does the U.S. no longer care about Saudi Arabia’s role in their essential oil supplies. Still, strategies inside the current government do not seem to be as cut and dry as those with previous administrations.

View Global Petroleum and Natural Gas Performance

Policy Shifts as Domestic Production Continues to Rise

In 2021, OPEC’s share of U.S. total petroleum imports was about 11%, and its share of U.S. crude oil imports was 13%. Saudi Arabia, the largest OPEC petroleum exporter to the United States, was responsible for 5% of U.S. total petroleum imports and 6% of U.S. crude oil imports. Saudi Arabia is also the largest source of U.S. petroleum imports from Persian Gulf countries. About 8% of U.S. total petroleum imports and 9% of U.S. crude oil imports were from Persian Gulf countries in 2021.

While the alliance between the nations persists under the current administration, its significance is no longer self-evident. A new government may opt to walk away from the decades-long relationship; due to the optics of doing business with the Crown Prince, Mohammed bin Salman. Of course, having a strategic ally in the region would also remain crucial. However, new powerhouses like the United Arab Emirates and Egypt could shift foreign policy. This shift would, in fact, pertain to the future of the oil and gas industry.

Oil Country Tubular Goods Imports and Tariffs

Another area the oil and gas industry needs to watch is the ongoing trade war between the U.S. and China. In 2016, prices for line pipe OCTG spiked after investigations revealed China’s exporters were still dumping steel products into U.S. markets. The administration’s tariffs serve as a way to combat these practices. Yet, smaller importers and domestic mills seemingly cannot make up for the difference required for expanding production.

Dumping, by definition, is the practice where manufacturers sell their products at an unfair price in certain economies. They do this to maintain a larger share of the market. Though this hurts manufacturers of OCTG in the domestic market, it actually helps producers commission and complete new wells. New Chinese and South Korean import tariffs will inevitably lead to fewer future wells coming online.

Keeping You Informed with the Latest Oil and Gas Industry News

In any event, the reduction in demand for domestic oil and gas partnered with the rise in production from shale oil in the local market will continue to shape the future of the US’s foreign policy.

MSI Pipe Protection Technologies strives to provide the highest quality pipe protection product equipment and devices. We also enjoy keeping you up-to-date with industry news and information. This is part of our goal in helping you deliver protected pipe all day, every day.

Get FREE Thread Protector Samples

With the oil and gas industry consistently in the spotlight with foreign and domestic stakeholders, MSI remains committed to helping protect critical investments.